ACM Update 09/05/22

Expect to hear the term ‘Stagflation’ more often. We are in for a period of low growth and high inflation with estimates that inflation will hit 10%. The man on the street may argue we’re there already. We expect the US to see inflation subside first with the UK and Europe lagging behind due to the ongoing conflict in Ukraine. Inflationary pressures should ease when supply chain issues decrease, and higher interest rates kick in to reduce demand. I expect to see continued Dollar strength for the foreseeable future.

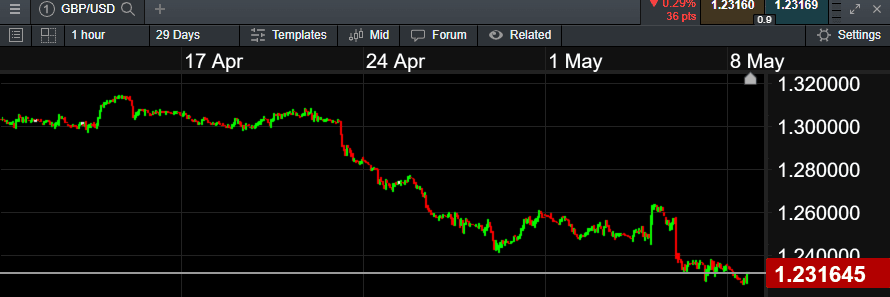

Sterling/Dollar

Cable (Sterling/Dollar) is down over 5.5% against the Dollar this month and over 10% on a 12-month basis. YTD we are down around 8.5%. You can view the movements over the past month in the graph below –

Do you have a requirement to convert USD into GBP? It may be prudent to cover off some of your exposure on a SPOT basis at current levels.

The Federal Reserve are expected to follow on from their 50bps increase with a further 50bps increase in June with expected increases up to 3.75%. We have US CPI data on Wednesday. If the forecast is right then it may be the first sign that peak inflation has been hit or is close to being hit. The US is also considering a reduction in import duties on Chinese goods to help slow inflation.

The Chinese economy due to tight ongoing Covid restrictions is continuing to harm supply chains.

If you would like a conversation around technical levels to target on a take profit order basis let me know. If you are on the other side of the trade and need to purchase Dollars let’s have a conversation around a strategy to help mitigate further downside risk. All indicators are pointing lower for Cable (Sterling/Dollar) at present.

Sterling/Euro

Sterling has taken a hit against the Euro to the mid-1.16s. There is a slightly more hawkish tone with a push for a July hike from the ECB (European Central Bank). If you’re a seller of EUR back into GBP look to take advantage of the move from over 1.20 just a week ago. You can view the movements over the past month in the graph below –

If you hold GBP consider protecting against any further downside moves. If you would like a conversation with one of our dealing team to implement a strategy please let me know.

Northern Ireland elections

Sinn Fein secured the most seats in the assembly election. Does this mean a poll/referendum is likely on Northern Ireland leaving the UK to form one country with the Republic of Ireland? Not imminently. There are still more unionists than nationalists in the Assembly. The immediate goal is to form a power sharing executive at Stormont with the DUP. The Northern Ireland protocol and a lack of an executive at Stormont mean political tension will remain heightened.

This week

Relatively light on data/releases. We have the ECB President, Christine Lagarde, speaking on Wednesday. From a UK perspective we have preliminary GDP (QoQ) (Q1) released Thursday with expectations for a print of 1% against a previous print of 1.3%. Any disappointment to the downside could mean further losses for Sterling.

If you have any questions, please reach out to me directly.

Have a fantastic week