ACM Update 02-01-24

2024 is now upon us and financial markets will be getting back into full swing this week. The final few weeks of 2023 saw the three major central banks, shifting focus slightly on their monetary policy. When will the long-awaited interest rate cuts start and who will be the first to blink?

The Dollar having been the biggest beneficiary of interest rate hikes over the last two years, has led to it losing the most thus far. Is this a sign of things to come though or just a temporary adjustment?

First and foremost, Happy New Year to all of our clients and partners. The ever-expanding Aston team look forward to assisting you again in 2024. As ever, we hit the ground running for the year and are now back in the office at full strength to help with any current and upcoming requirements.

Looking back at the final few weeks of the year gone by, the outlook on monetary policy has shifted somewhat since my last update. Starting off with UK data, the Bank of England (as expected) held UK interest rates at their highest position in fifteen years.

The move marked the third consecutive hold from Andrew Bailey & Co, with the decision a 6-3 split. In fact, the voting split mirrored the previous month, with the same three hawkish members (Swati Dhingra, Megan Greene & Jonathan Haskel) interested in a rise to 5.50% instead.

Andrew Bailey would not be drawn into giving any sort of outlook on pending rate cuts though. The Bank of England Governor remained tight-lipped on the topic to keep markets guessing. Current expectations place the forecast cuts to start in the summer, with a 1% drop in headline interest rates by the end of 2024.

A lot of this fits with the “Table Mountain” & “higher for longer” rhetorics we have seen of late. However, markets are pricing in the rate cuts due to inflation falling, as well as growth stalling. We may well return back to my favourite word of stagflation over the course of the next 6 months on UK soil.

Starting off with inflation, this has continued to come down in recent months. December 2022 saw inflation running hot at 10.7%, but the final month of 2023 saw the same CPI metric at 3.9%. This is still higher than Germany, the EU as a whole and the United States, but on a par with France. The figure is getting closer to the BoE’s 2% target, but energy and fuel concerns remain in light of the geopolitical uncertainty in the Middle East and Ukraine. The closer the metric gets to 2%, the more likely interest rates are to begin to fall.

On the growth side of the coin, well there still isn’t really much of it! In fact, UK GDP for Q3 was revised down to -0.1% versus the previous estimate of 0.0%. This means that once Q4 data is finalised, we could already find the UK in a technical recession. This could be another reason for interest rates starting to fall sooner rather than later.

For now though, UK data for November performed better than expected, with a surprise jump of 1.3% in retail sales, compared to October.

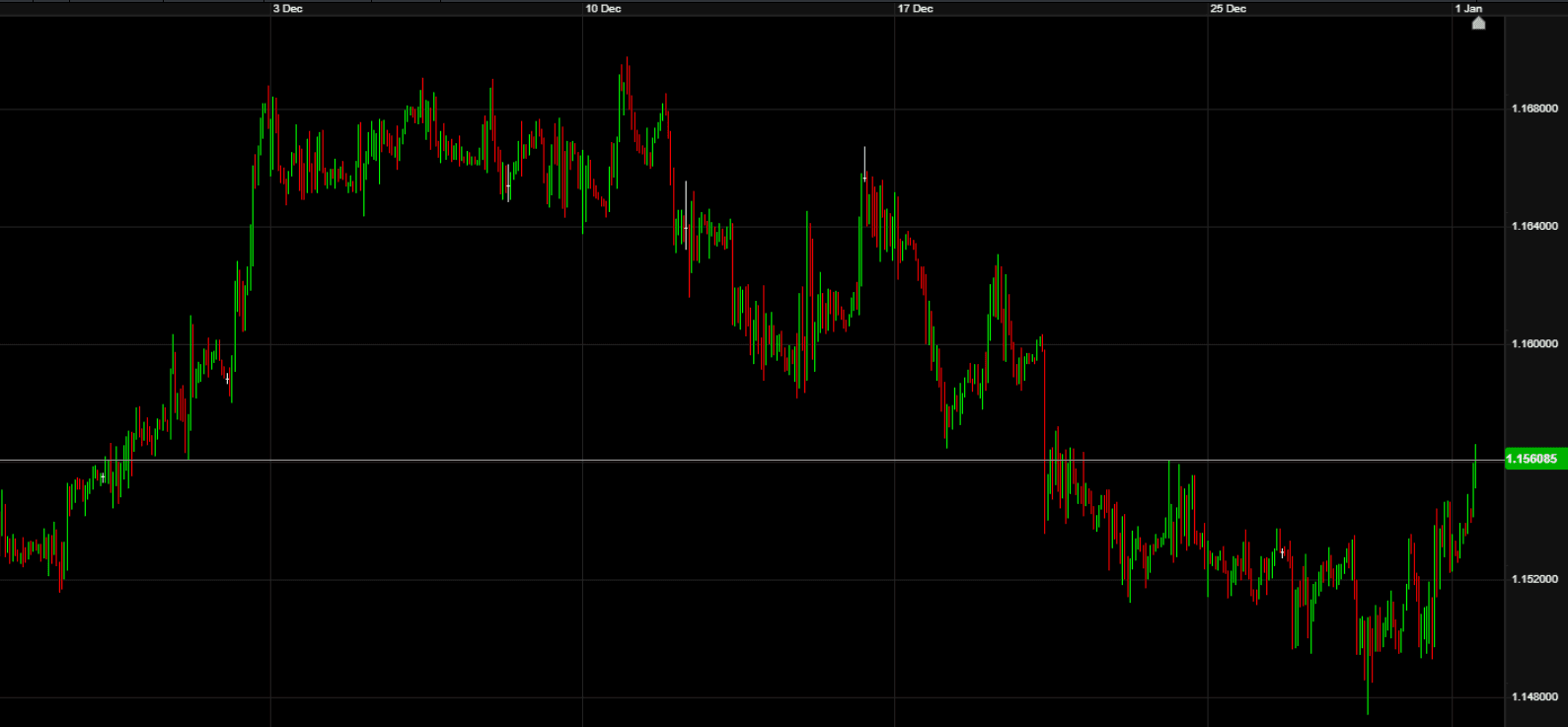

Overall, sterling can be best described as “steady” in 2023. A total movement range of just over 5.5% versus the Euro throughout the year is remarkably narrow, but also outlines the stalemate between the two economies at present. Whichever blinks first on rate cuts in 2024 could well see their currency on the back foot. December movements on GBP-EUR can be seen below:

On the subject of the Eurozone, the European Central Bank also held interest rates just before Christmas. Again, this was as forecast and President Christine Lagarde refused to provide thoughts on when rate cuts may appear from Frankfurt.

However, there was a change in narrative in the subsequent press conference surrounding inflation. Previously, the ECB have stated on the subject of inflation that it is “expected to remain too high for too long”, which has now shifted to expecting it to “decline gradually over next year”.

This may seem like a very subtle change, however it does suggest that the ECB are now shifting their focus more towards rate cuts over the coming months. Current expectations are for a March meeting cut, which feels about right given how inflation is trending in the bloc.

The ECB conference also took the move to revise growth forecasts lower. Another factor which could well signal rate cuts sooner rather than later. For the year as a whole, the Euro remained relatively static, driven by movements from other major currencies, with swings of almost 8% against the Dollar.

The Federal Reserve meeting took place the day before the Bank of England & ECB. Jerome Powell & Co also opted to hold their own interest rate for the third meeting in a row, in a move just as widely-expected.

However Powell was much more forthcoming with his thoughts regarding 2024’s policy. He stated that rate increases were “not the base case anymore”, as well as “that’s us thinking we have done enough”, when quizzed about why further rate hikes were not discussed.

As a result, markets now expect the Fed to be cutting rates “sooner rather than later” this year. In line with the ECB, current expectations are for such cuts to start in March, with three cuts already priced in, and a total reduction of 1.5% by year-end.

The Dollar has thus been weakening off in recent weeks, touching highs around 1.28 during the Christmas period. Moves during December can be seen in the chart below:

As eluded to, policy moves will likely be a major driver of GBP, EUR & USD into 2024. If the Bank of England do as expected and keep interest rates “higher for longer” then we could well see GBP having a positive first half of the year. This however will rely on growth data starting to perform, as a flatlining GDP picture may force the Bank of England’s hand.

For the ECB and Federal Reserve, March could well be a very interesting time for their respective monetary policies.

The week ahead:

Tuesday – SPA/ITA/GER/FRA/UK/CAN/USA Manufacturing PMI (08:15-14:45 UK time)

Wednesday – German Unemployment (08:55), ISM Manufacturing & JOLTS Job Openings (15:00), Federal Reserve Meeting Minutes (19:00)

Thursday – EU Services PMI (09:00), UK Services PMI (09:30), ADP Employment Change (13:15) US Unemployment Claims (13:30)

Friday – German Retail Sales (07:00), UK Construction PMI (09:30), EU CPI Flash Estimate (10:00), US Non-Farm Payrolls (13:30)

A new year and plenty of data to look forward to. No central bank meetings for a few weeks yet, as these start to roll in from three weeks’ time. Two key data releases this week will be the EU’s latest inflation estimate, and the US Non-Farm Payrolls. Both land on Friday.

As already eluded to, any slowdown in EU inflation could force the hand of the ECB’s rate-setting committee. That said, a rate cut in their next meeting on 25th January feels a little premature. On the US side, the Christmas jobs numbers will be an excellent indicator of the performance of the US economy, and whether the holy grail that is the “soft landing” is still on the horizon.

As always, make sure to reach out to the team if you have any queries and we will be here to assist.

Have a great week and once again, the Aston team wish you a Happy New Year!