ACM Update 31-03-25

Rachel Reeves and UK economic data were both in focus last week. The Chancellor delivered a Spring Statement featuring a slashed growth forecast, whilst maintaining she was sticking to her self-imposed fiscal rules. The latest inflation figures for February saw a slight softening.

For the US, Trump tariffs held the headlines whilst consumer confidence dropped for the fourth straight month. With Core PCE inflation up, talk of stagflation looms larger on the horizon.

A new month and a new quarter both begin this week. All eyes will be on the range of US jobs data from March, with the crescendo being the Non-Farm Payrolls release on Friday lunchtime.

Another busy week for UK events is behind us, with plenty to digest. Let’s start with UK inflation, which softened slightly compared to the month before. The 2.8% reading remains above the Bank of England’s mandated 2%, but did show a drop compared to January’s 3%. The movement down was welcome but unexpected and was attributed to a drop in the price of women’s clothing. The BoE will have another month’s worth of data, before they next decide on interest rates in early May.

UK Retail Sales data also arrived last week on Friday morning. This showed strength in a 1% month-on-month growth, having been projected to fall, which benefitted GBP initially in early Friday trading.

Aside from the above releases, the stage was Rachel Reeves’ on Wednesday lunchtime in the House of Commons. The UK Chancellor delivered her Spring Statement (not a Budget). With costs spiraling since her October Budget, the Chancellor had used up all of her £9.9bn “headroom” but managed to come out with a set of figures that gave her an identical £9.9bn worth of headroom again, to last until 2030.

She maintained that she would be “sticking to her fiscal rules” with regards to borrowing, something which Shadow Chancellor, Mel Stride, referred to as “fiddled fiscal rules”. Stride suggested that there were more last-minute changes to her figures than to her LinkedIn profile…..

The Chancellor also had to pass on news from the OBR (Office for Budget Responsibility) that the UK’s growth forecast for 2025 had been downgraded. The figure was slashed from the 2% indicated in October, to 1% now. Reeves blamed this on “foreign trade factors”, whilst many analysts suggested her incoming tax policies were more to blame.

The OBR marginally upgraded the projected growth forecasts for the following three years, but all remain under 2% annual growth.

There were major changes to welfare spending, housing schemes, defence and overseas aid, as well as public services including 10,000 civil service job cuts. Aside from all the numbers and stone throwing though, sterling itself saw little movement during Wednesday lunchtime’s statement.

The Bank of England Governor, Andrew Bailey, also spoke last week. He sees “strong headwinds” preventing growth. Bailey referred to businesses remaining cautious, ahead of the incoming changes to national insurance which arrive imminently.

Sterling saw approximately 1% worth of movement last week versus the Dollar, but closed almost exactly where it opened the week, in the mid-1.29s. Movements on the pair can be seen below:

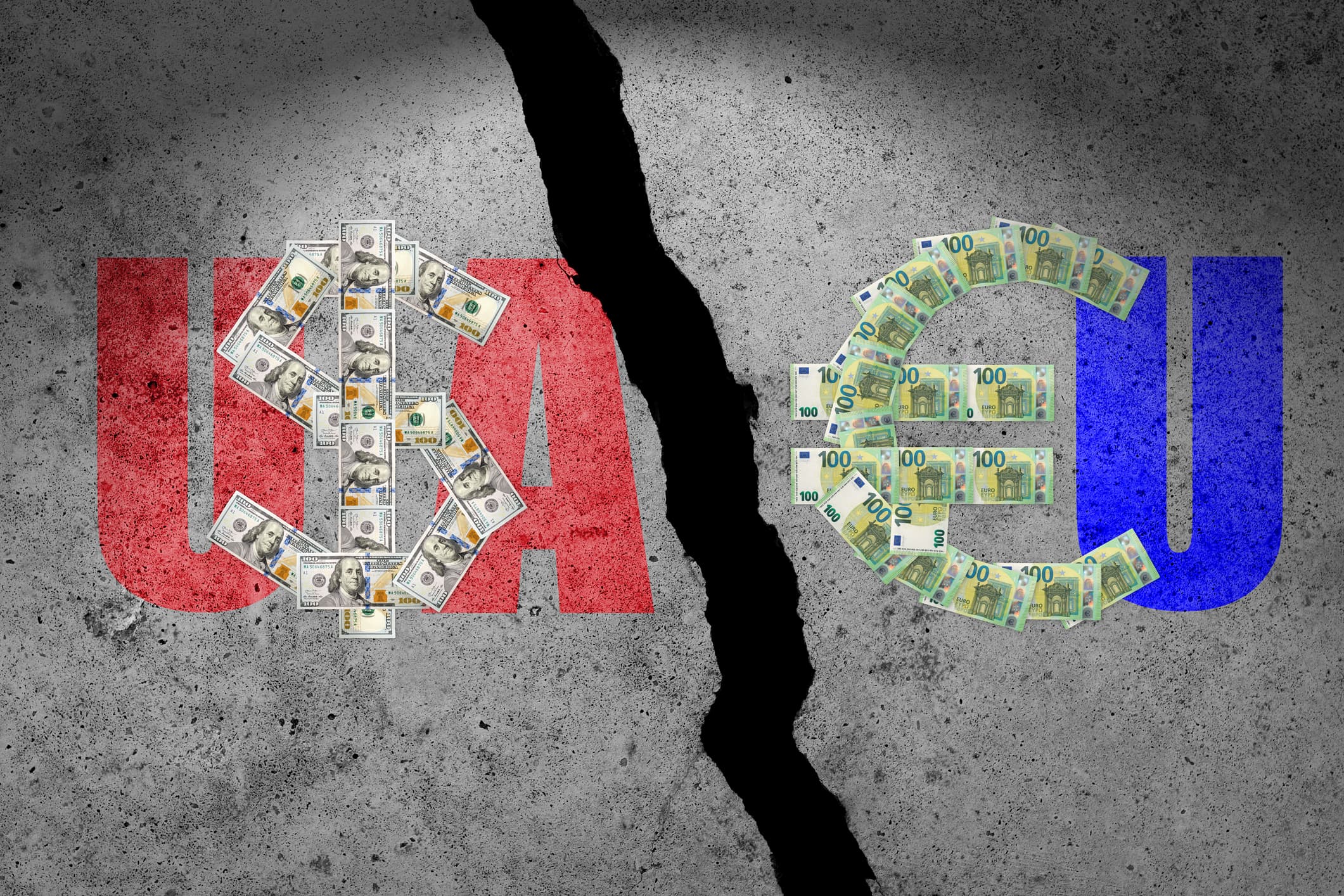

Over in the US, Donald Trump continued to dish out tariffs like confetti, much to the dismay of other nations. The President announced a raft of new tariffs to begin this week on 2nd April, with one major area being car/car parts imports. Foreign-made vehicles are to be handed a 25% tariff, with some analysts suggesting the move could lead to a temporary shutdown of some US car production, as well as higher prices for consumers.

Trump stated over the weekend that he “couldn’t care less” about higher car prices. However, anyone with an eye on inflation, such as the Federal Reserve, will be acutely aware of the potential knock-on effects. With reducing the cost of living for Americans being one of his major promises, we seem to be rapidly heading the wrong way.

The President continues to face heat from elsewhere on his tariffs. Reports suggest that the UK are willing to retaliate on any tariffs imposed here, whilst Canadian PM, Mark Carney, stated “the old relationship with the US is over”. The former economist urged Canadians to “fundamentally reimagine our economy” as he bids to win an election in four weeks’ time.

Amidst all the tariff talk, the US economy seems to be bearing the brunt of the impact. Consumer confidence there dropped for the fourth straight month in March, now at its lowest since January 2021 (during COVID lockdowns).

Core PCE inflation data, which is the Federal Reserve’s chosen inflation measuring tool, showed a bigger than expected increase too. This has reignited fears of US economic stagflation, with growth falling and inflation (seemingly) rising. Consumer spending did rise slightly in February, but by less than forecast.

This week’s jobs releases for March may give the clearest indication yet of what is to come on US soil. Expect volatility around Friday lunchtime.

In Europe, the continent seems to be riding the (albeit small) wave generated by the recent German debt deal. The Eurozone Services PMI reading rose to a 7-month high in March of 50.4 whilst the Manufacturing equivalent hit a 26-month high. The data for the German economy itself was better than expected too, as a result of improvements in the Manufacturing sector.

With growth still fragile, the EU is desperately trying to not upset the apple cart and met with Donald Trump’s trade officials last week. The EU’s trade commissioner, Maros Sefcovic, was in Washington with the aim of avoiding the sizeable tariffs due to be implemented this week. This was the third attempt, but ended with a “the hard work goes on” post on social media from Sefcovic.

Christine Lagarde also briefly spoke on tariffs last week. She conceded that the EU needs to be ready for “tariff blackmail” from Trump 2.0.

GBP-EUR movements last week can be seen in the chart below.

The week ahead:

Monday – German Retail Sales (07:00 UK time), German Prelim CPI (10:00), UK Mortgage Approvals (09:30)

Tuesday – Reserve Bank of Australia rate announcement (04:30), BoE Greene speech (09:15), EU CPI Flash Estimate (10:00), ECB Lagarde speech (13:30), US ISM Manufacturing PMI & JOLTS Job Openings (15:00)

Wednesday – ADP Non-Farm Employment Change (13:15)

Thursday – EU/UK/US Services PMI (08:15-15:00), ECB Meeting Minutes (12:30), US Unemployment Claims (13:30)

Friday – US Non-Farm Payrolls (13:30), Fed Powell speech (16:25)

As Q1 comes to an end, summer is hopefully on the way in the northern hemisphere. On which note, clocks in the UK & Europe went forward over the weekend by an hour.

This week will be heavily focussed on the US, both in terms of data and events. Donald Trump is due to launch his major round of tariffs on Wednesday, in what he is calling “Liberation Day” for the US economy from unfair trade practices elsewhere. The next couple of days are likely to produce a flurry of meetings with his top trade officials, with various countries looking for exemptions.

Data-wise, the biggest events of the week come from the US also. March’s jobs data is to be released, which would be an indicator of the overall health of the employment market there. A key mandate for the Federal Reserve, a weak figure would certainly spark market concern when released on Friday lunchtime.

In the EU, the minutes from the latest ECB meeting are released on Thursday lunchtime. These are likely to point to more commentary about their meeting by meeting, data dependent approach to policy. The topic of a neutral rate (where interest rates level off) may have been a talking point though.

In the UK, a fairly quiet affair. Aside from a speech from Bank of England member Megan Greene, the focus should just be on the fallout from Rachel Reeves’ Spring Statement. Equally, the changes to National Insurance which kick in at the end of this week when the new tax year starts. On which note, any clients needing to execute trades before the end of the tax year still have time, so do reach out to the team.

With Trump and US jobs in the limelight, we should be in for a busy second half of the week. Markets are expected to be choppy in and around these events, so make sure to reach out to the team for more ways to protect your foreign exchange payments.

Have a great week.